Nursing home administrators say inflation has most affected costs for nurses and other labor over the last year, but higher charges are also forcing many to close wings, restrict admissions and put off needed construction and renovation projects.

Those are among the findings of the 2022 McKnight’s Mood of the Market survey, which asked nearly 750 administrators, directors or nursing and other nurse leaders about job satisfaction and operating conditions.

Responses were collected through email solicitations over a two-week period spanning late July and early August.

They show building leaders are scrambling to cope with inflation and costs that have driven up the price of everything from personal protective equipment to pharmacy services.

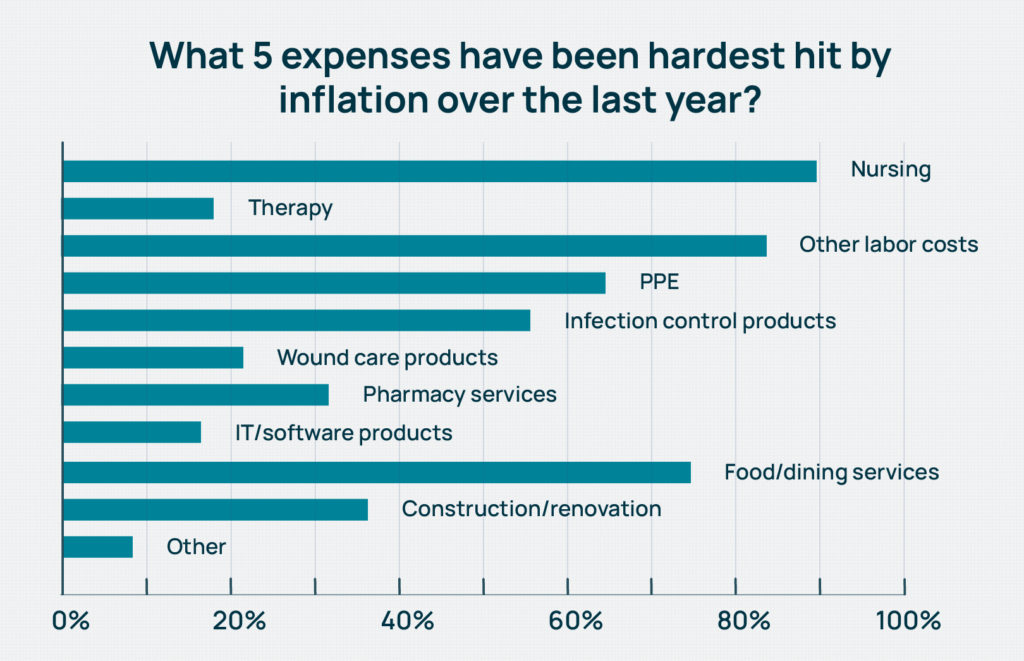

Asked what five expenses had been hardest by inflation over the last year, respondents’s most common answers were nursing (90%), other staffing or labor (84%), food and dining services (75%), PPE (65%) and infection control products (56%).

With fewer job candidates, high demand and persistent pandemic conditions, it’s no surprise that building leaders put nurse staffing costs first. Nursing home nurses averaged double-digit pay increases this year, with hourly rates for certified nurse aides soaring by 11.2% to $16.87. Registered nurses reported a jump of 11.1%, according to the 45th annual HCS Nursing Home Salary & Benefits Report issued in late July.

But rising construction costs were also a strong contender, with about 36% of all respondents citing it among the costs most affected by inflation. The number rose to over 40% among the administrators-only crowd.

“The increasing construction costs are driven by many of the same factors that are driving cost escalation on other fronts such as the cost of food, supplies. The staffing and related wage pressures are weaved into all of this as well,” Lisa McCracken, research director for investment firm Ziegler, told McKnight’s Long-Term Care News. “Staff shortages remain an issue across the board and employers are having to increase wages exponentially.”

Meanwhile, labor and materials costs affecting the construction trade have caused costs to escalate unpredictably, which makes getting back into capital improvement mode extra challenging.

“We know of projects that were priced six months ago with certain financial models and now the project costs are 50 to 80% higher,” McCracken added. “It has been difficult to estimate costs with the needle constantly moving.”

It makes sense then that delaying or canceling construction was also the top way respondents said their facilities had chosen with overall rising costs.

Just under 50% of Mood of the Market respondents overall said they’d put off a building or capital improvement project, while that portion climbed to more than 53% among administrators. Nurses leaders chose restricted admissions as a cost-saving measure (second most often at 40%), about 1.5 points higher than administrators. Twenty-nine percent in each job category said they’d discontinued services such as recreation activities, trips or entertainment.

Limiting investment in physical plant while also limiting admissions sets a dangerous precedent for skilled nursing operators, whether or not it’s due to costs of staffing shortages, McCracken said.

“There may have been providers who were going to embark upon reinvestment projects going into the pandemic, put those on hold and are now putting them on hold again because of cost escalation,” she said. “In those instances, you are now years behind a reinvestment that is needed to remain competitive and aligned with what the customer wants. You can get into a downward cycle pretty quickly here.”

6% more express census return

McCracken said that overdue projects are also affected by lower census, which leads to reduced revenue.

Overall, almost 27% of the Mood of the Market respondents said that their census had already returned to pre-pandemic levels. Last year at this time, only 21% of survey-takers were there.

But for the rest, when more beds will be filled is scattershot. Fifteen percent predicted either the third or fourth quarter of this year, while about 19% chose the first half of 2023. Another 27% predicted full recovery in the second half of 2023, in 2024 or 2025. And just over 12% said they “never” expected a return to pre-pandemic levels, up from 9% last year.

Providers have warned for months that they are leaving beds unfilled because they can’t find staff. But some have also intentionally shut wings or buildings rather than pay inflated staffing costs.

Understaffing resulting in lower occupancy, however, was estimated to cost providers $19.4 billion in unrealized revenue, according to a June study conducted by international consulting firm Oliver Wyman and commissioned by staffing firm IntelyCare.

“Reduced occupancy leads to financial challenges, which further pressures the ability to reinvest, and that is where the downward cycle comes into play,” McCracken noted. “We understand that these can be difficult decisions on the cost front, but we would encourage providers to explore all possible scenarios before pulling the plug on a project. Downsizing or a multi-phased approach might be the more balanced alternative given all of the considerations at hand.”

More cost factors

Rounding out the top five ways in which providers cope with rising costs were eliminating agency staffing (24%) and , at a somewhat surprising level, holding off some kind of staff benefit or pay at 22%.

In earlier Mood of the Market coverage this week, McKnight’s reported that a majority of nurse leaders and administrators put higher salary among the top two changes that would improve their job satisfaction. Better health insurance or benefits, however, interested only about 21% of building leaders.

That makes sense to Matt Stokes, a compensation analyst with Total Compensation Solutions, who says many nurses, including RNs, are more concerned with take-home pay. They, too, feel the pinch of inflation.

When it comes to saving money, it might not be a mistake to tweak benefits for certain employee groups.

“That really is affected by the age of the employees you’re talking about,” Stokes said. “Young people never think they’re going to get sick, and most think they’re never going to retire. So for that age group of individuals, they’re all about show-me-the-money … With the prices of everything just getting so out of control, pumping that money into their benefits or retirement, it’s almost a waste because they don’t think they’re ever going to use it.”

One bright spot in the survey: Therapy costs did not appear to be overly influenced by inflation among those surveyed. Just under 18% of respondents cited it in their Top 5 for inflation effects. That was compared to 84% who chose “other staff” as among the most inflated costs.

But it may be the case that many building leaders who completed this year’s Mood of the Market survey are insulated from true therapy cost increases.

“Therapy costs have gone up to the therapy provider over the last year due to inflation, like most every other item in the economy,” Manning McGraw, CEO of Broad River Rehab, told McKnight’s Wednesday. “We, the therapy companies, have contractual arrangements with the facilities that we provide therapy to that are independent of our labor costs, so they do not feel this increase in labor cost. … My guess is that the majority of the 17.88% that are saying this cost is up are in-house providers as they now own the payroll.”

This is the final article in a three-part series. See what factors administrators and nurse leaders say are leading them to ‘breaking points’ in the first, and read the second to learn what they think owners and operators should do to improve job satisfaction.